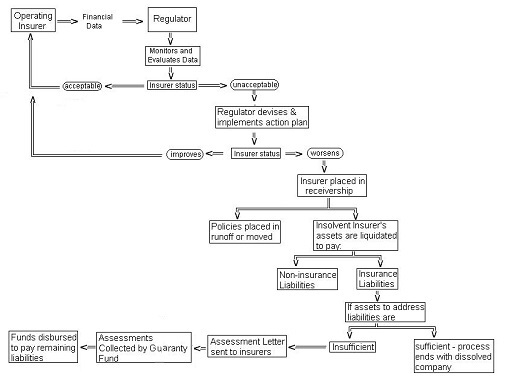

THE MONITORING PROCESS

(March 2023)

A troubled insurance

companyís fate can vary wildly. In most instances, an insurer remains viable

for many years. When change comes, it may more likely merge with another

insurer or be purchased by a larger company. The norm (and desired situation)

is that being placed into receivership is a rarity.

If things are

working properly, an insurance companyís performance is watched by, typically,

a given stateís insurance regulatory body. In the course of monitoring, an

insurerís weakened position should be identified and corrected.

In general, the

process a state goes through with monitoring property and casualty insurers

involves the following:

- Collecting annual financial statements

from all insurers

- Examining the information and, using

some selection basis, running key information through a set of financial

tests

- Evaluating information on insurers with

financial statements that raise warning signals

- Performing audits on selected companies

- Depending upon audit results:

- Letting the company operate as usual (if audit results are positive)

- Creating a program of corrective action (typically requiring quarterly

or monthly, rather than annual, financial reports)

- Following up on corrective action

- If the situation deteriorates, considering more drastic action

- Placing company under conservatorship

- Attempting rehabilitation (if

conservatorship does not work or if rehab is selected instead)

- If rehabilitation fails, consider

finding the company insolvent

- If applicable, issuing a Final Order of

Liquidation

- Liquidating the insurerís assets and

using this to fund insurerís obligations

- Collecting assessments to fund any

shortfall

Here is how a

situation may appear:

|

|

Monitoring

Tools

As already mentioned,

state regulators receive insurer financial statements each year. These

statements are routinely evaluated against a set of tests. One test standard is

the Insurance Regulatory Information System (IRIS) ratios. It consists of 11

(P&C insurers) or 12 (Life insurers) ratios that can be calculated using

any insurerís financial statement data. The ratio results can be compared to

established benchmarks that may indicate financial problems. The ratios are:

IRIS Ratios |

|

|

Ratio |

Explanation |

|

Net Premiums Written/Policyholders Surplus |

Annual Net Premiums divided by that insurerís policyholder surplus.

Typically, a flag is raised when ratio exceeds 3.00. |

|

Change in Net Premiums Written (NPW) |

The change in NP written in the latest year divided by the annual net

premium amount from the previous year. |

|

Surplus Aid/Policyholders Surplus |

(Ceded Reinsurance Commissions divided by Ceded Reinsurance Premiums)

x Unearned Prem. For reinsurance ceded to non-affiliated companies |

|

Two-Year Operating Ratio |

Sum of loss ratio and expense ratio, less the net investment ratio

measured over two years |

|

Investment Yield |

Annual Net Investment Income multiplied by two, divided by the annual

average of cash and invested assets. |

|

Percent Change in Policyholders Surplus |

The change, expressed as a percentage, between an insurerís current

and previous yearís surplus |

|

Liabilities/Liquid Assets |

Total Net Liabilities divided by Total Net Liquid (cash and near cash)

assets |

|

Agentsí Balances/Policyholders Surplus |

Balance owed by agents (being collected) divided by policyholder

surplus |

|

One-Year Reserve Development/Policyholders

Surplus |

Outstanding Incurred Loss Estimate (minus current year info.) divided

by policyholder surplus |

|

Two-Year Reserve Development/Policyholders

Surplus |

Outstanding Incurred Loss Estimate (minus last two yearsí info.)

divided by policyholder surplus |

|

Current Estimated Reserve

Deficiency/Policyholders Surplus |

Current reserve estimate minus actual reserves reported |

|

Gross Premiums Written/Policyholders

Surplus |

Total of Written premium from business that is written directly as

well as from reinsurance issued by affiliates and non-affiliates. |

Generally, failure

to meet benchmarks of four or more ratios is an indicator that the applicable

insurer may be having financial problems. Corrective action then takes place,

such as more frequently reporting and evaluating subsequent financial data

and/or insurance audits.

Related Article: Monitoring Insolvencies Ė Risk Based Capital